Seeing how 2017 has been a big year for data breaches, it’s not surprising people are becoming more and more paranoid about using credit cards - not just online, but in brick and mortar stores as well. The sad truth is that you can do all the right things and make all the right moves to protect your banking information and credit cards and you can still be a victim to a data breach. The only sure-fire method to avoid this is to pay with cold, hard cash. Unfortunately, it’s kinda impossible to pay with cash over the Internet. Prepaid cards work nicely but they can have annoying fees and many online retailers refuse to accept them. So what’s a guy to do?

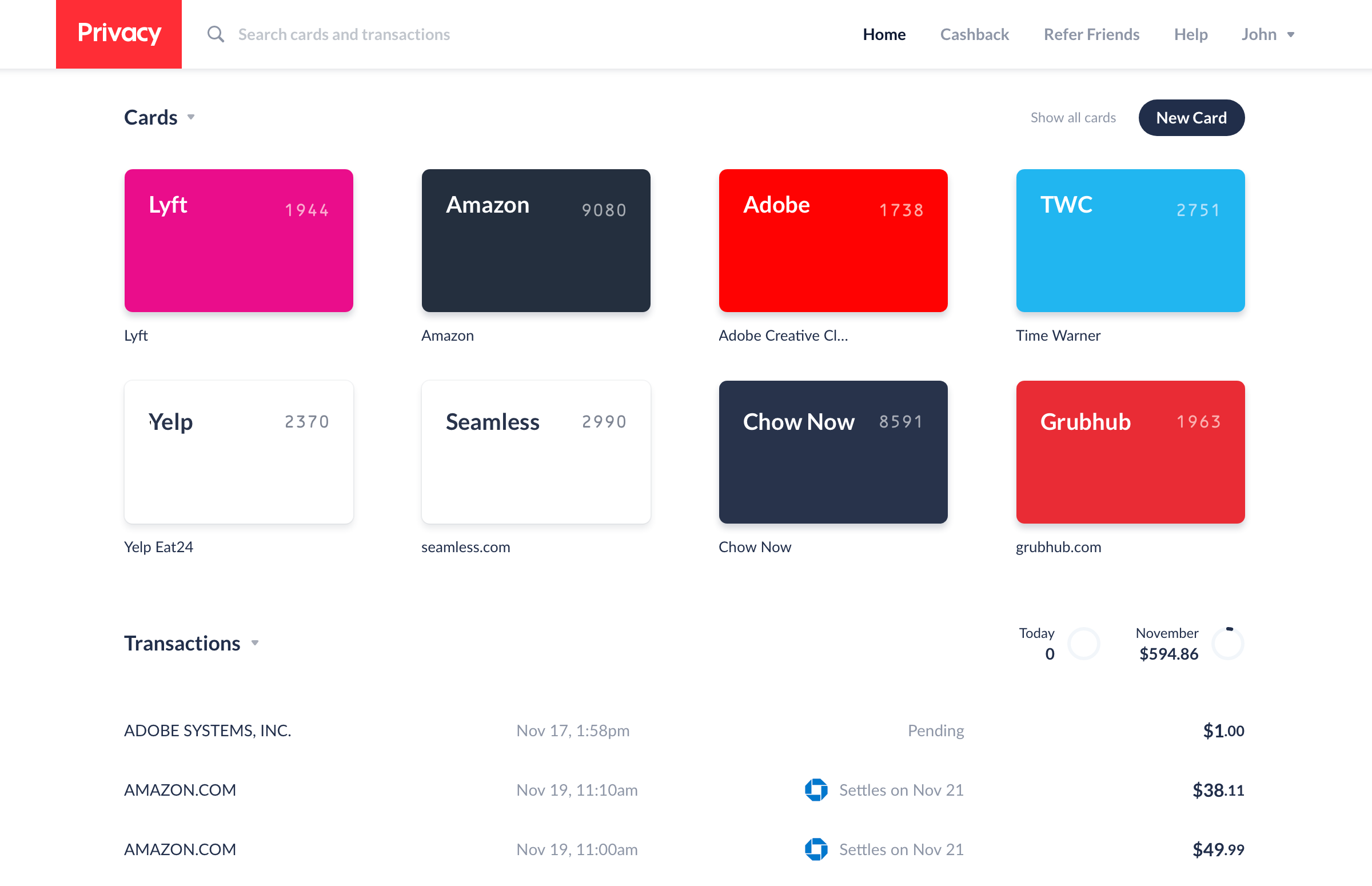

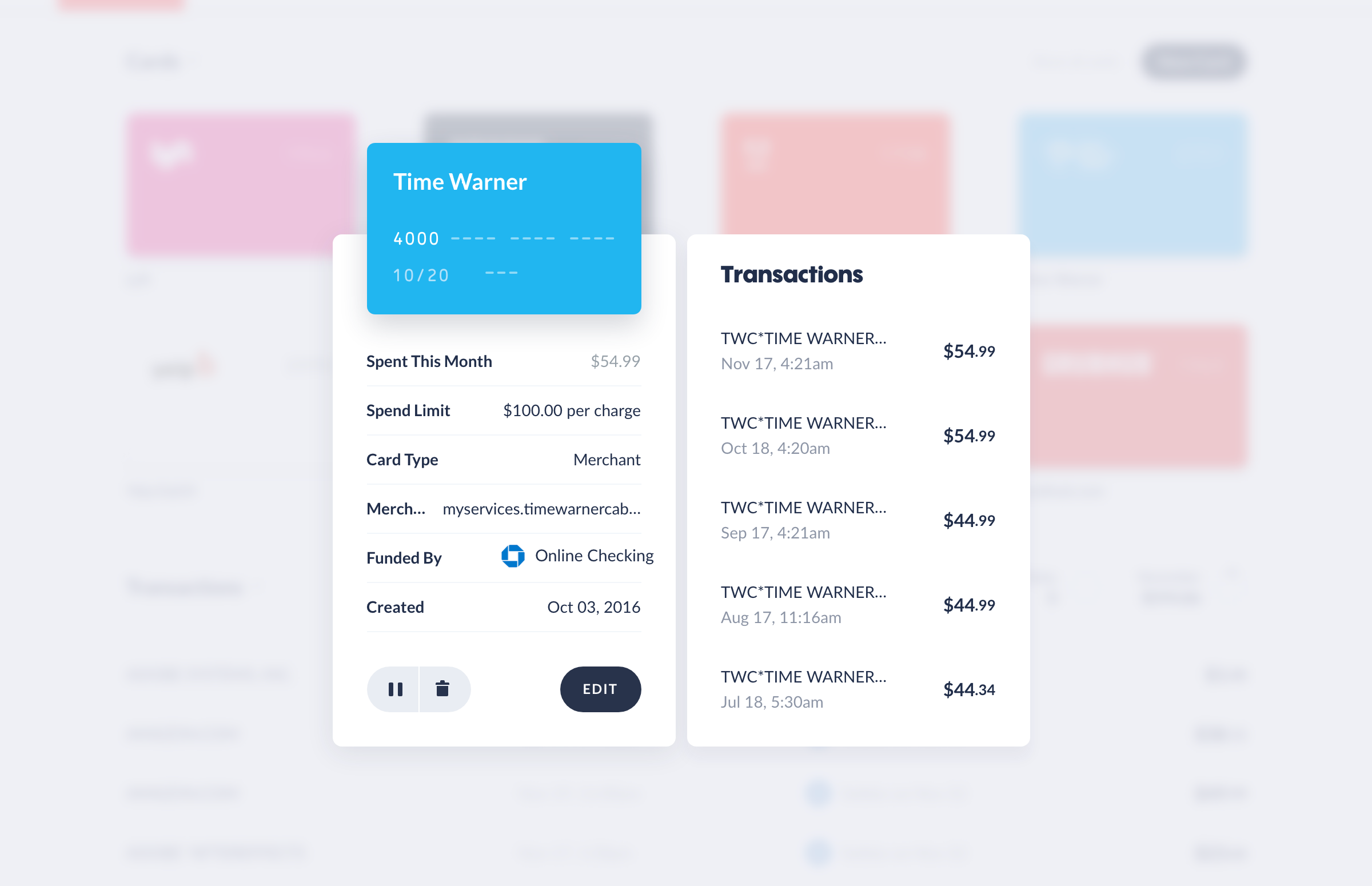

In 2016, a startup called Privacy.com launched to solve this problem. The service works by linking your bank account and providing virtual Visa cards that are usable by a single merchant. When the merchant charges the card, Privacy.com charges pays them and charges your bank account. The merchant never gets your actual banking information and your bank never sees who you’re actually doing business with.

Additionally, you can set monthly or one-time spending limits for each card. You can create “regular” cards that a merchant can charge repeatedly, such as a card for Netflix. You can also create “burner” cards that are good for one-time transactions. Such cards can come in handy for merchants you don’t fully trust or for signing up for a “free trial” that will be automatically billed if you forget to cancel.

In my opinion, the single greatest feature Privacy.com offers is their wildcard support for billing information for the cards you create. You can use any name and address for the billing information for the cards, thus allowing you to remain completely anonymous to the merchant you do business with. Couple this with a ghost address for shipping and you can finally shop on Amazon without ever revealing your true identity or having a profile built around your shopping preferences or watch Netflix without your viewing habits being connected to your identity.

I personally use a different ghost address for each account I have a Privacy.com card for. This way, not only does the merchant not have my real information, but those (many) merchants who toss your information into a third-party database (you know…those “business partners” their Privacy Policy makes exceptions for sharing your data with) will be doing my bidding for me by adding my ghost address to that ever growing database - adding even more obscurity to my actual whereabouts.

The only true caveat with Privacy.com is that you trust them with your information. They not only have your banking information but also your purchase information. However, without using them as a middle-man, your bank and merchants of choice would have a direct connection to one another. Then again, it’s practically impossible to have ultimate privacy if you have a bank account in the first place. Privacy.com certainly isn’t a perfect solution, but it definitely provides a great buffer and another excellent tool in your arsenal for protecting your shopping habits and your bank account.

I’ve spoken with the Privacy.com Staff and they say the ability to pay with a credit or debit card instead of a bank account is definitely on their roadmap for the future. Hopefully they’ll offer the ability to pay with a Visa Gift Card or other pre-paid card to further add to a customer’s anonymity.

If you’re interested in giving Privacy.com a try, you can use my referral link. The only reward I get for anyone using my link is the ability to get cashback on my purchases through them. I get no kickback or payout for any referrals.